By: Erin O’Shea, CFO of SEED SPOT

You may have heard that there is cash available under the CARES Act for small businesses including independent contractors. One of the things that has confused people is the fact that the loan amount is based on average payroll. If you’re working solo, you may not even be drawing a salary, in which case there is no payroll! Don’t worry though—the CARES Act specifically says that “sole proprietors, independent contractors, and eligible self-employed individuals” are included. So let’s look at what “eligible” means and how to improve your chances of getting approved.

Eligibility

As an independent contractor, you already meet the size requirement of fewer than 500 employees. The only other carve-out in the CARES Act is that the U.S. must be your principal place of residence. However, the SBA has other limitations including the following:

- No illegal activities as defined federally (i.e., dispensaries)

- No one delinquent on child support

- No agriculture apart from coops, nurseries, and aquaculture

- No sex industry

- No gambling (33% of revenue or more)

- No lobbyists, government entities, nor members of Congress

It’s not a rule, but anecdotally we’ve also heard foreigners residing in the US are also having issues.

Calculating the Payroll and the Related Loan Amount

As a solopreneur, your Payroll is defined as your gross revenue. To be specific:

[Payroll Costs means] the sum of payments of any compensation to… a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self- employment, or similar compensation.

The grant/loan amount under the PPP is your average one-month average Payroll multiplied by 2.5.

To calculate your Payroll, you can use your revenues for the prior twelve months or for calendar 2019 (other options are available for seasonal businesses). Given that this program is first-come-first-served, your highest priority should be to make the calculation as easy to support as possible so that your banker can quickly review and submit it. This means you are much better off if you can use 2019 as your baseline because you’ll have a tax return that ties to it.

Besides your tax return, you can use federal payroll tax filings and 1099-MISC for revenue verification. If you want to try to use 2020 data, it’s going to be more complicated, but you could use quarterly filings, customer contracts, and bank statements/cancelled checks to prove the revenues.

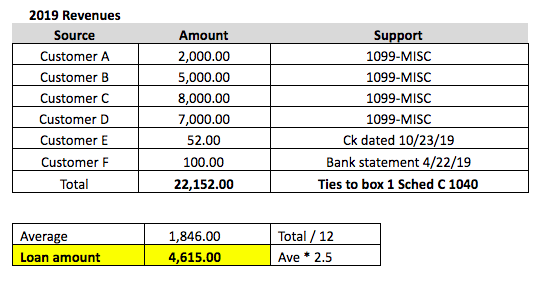

Regardless of which period you’re using for your average, it is in your best interest to show the calculation in a way that ties it out to the support. For example, if you have four 1099-MISC from last year plus some other amounts on your tax return, you could provide a spreadsheet like this:

Along with the items mentioned in the Support column, the above gives the bank exactly what they need to make sense of the bundle of support you’re attaching. Notice that the Loan Amount is easy to find and that the total of our individual support ties to the total on the tax return. Don’t make your bankers hunt for things and don’t make them do math. The banks are dealing with high volumes, so the quicker they can validate your numbers, the more likely you are to get sent on for approval.

Loan or Grant?

The PPP can be free, but to make it so will require a separate application later. For forgiveness, you’ll need to show that you have used the funds to pay rent, mortgage interest (note: not principal nor escrow), and/or payroll during the eight weeks following the loan. The payroll part is a little odd for independent contractors, in that payroll is paying yourself. Since this program is new and there have been no applications yet for forgiveness, there is no way to say how the banks will interpret this. We would expect some guidance on the subject to come out in the next couple of months.

In the event that not all of the use of funds is eligible to be forgiven, you will find yourself with a two-year loan that has interest of 1% and no payments due for 6 months. Not as good as free money, but nothing to sneeze at either.

Other Useful Information

The PPP caps all individual payroll amounts at $100,000, so if your total above is greater than $100,000, you’ll need another row stating that the $100,000 maximum applies. You’ll use the $100,000 divided by 12 to get your monthly average of $8,333.33 and your loan amount of $20,883.33 (monthly x 2.5).

If you go to a bank with which you have an account, the process will be faster because that bank has already identified your identity. If you go to a new bank, they’ll be required to run Know Your Customer (KYC) checks on you as required by federal law.

Funding for this program is expected to run out quickly. If you want the loan, you need to file as quickly as possible. You can most likely do so on your bank’s website. Good luck!

This article was written by Erin O’Shea, CFO of SEED SPOT with 20 years of corporate and small business treasury/banking experience. These days, she is very popular with her dogs who think this working-from-home thing is awesome.

1: HR748 (The CARES Act) Sec. 1102 (a)(2)(36)(D)(ii) https://www.congress.gov/bill/116th-congress/house-bill/748/text#toc-HCCF2DA7CBD6341059EAB97C24489743B

2: HR748 (The CARES Act) Sec. 1102 (a)(2)(36)(A)(viii)(I)(bb) https://www.congress.gov/bill/116th-congress/house-bill/748/text#toc-HCCF2DA7CBD6341059EAB97C24489743B

3: Average of the 12 weeks starting 2/15/19 or the period from 3/1/19 – 6/30/19 as elected by the applicant. HR748 (The CARES Act) Sec. 1102 (a)(2)(36)(E) https://www.congress.gov/bill/116th-congress/house-bill/748/text#toc-HCCF2DA7CBD6341059EAB97C24489743B

The post Paycheck Protection Program (PPP) Tips for the Self-Employed appeared first on SEED SPOT.